But instead of, “I’m going to lose 10 pounds by Wednesday.” That’s ridiculous. Like maybe you want to lose one pound per week.ĪC: That would be 52 per year, that’d be a lot.ĪC: So you probably don’t have to do that much. JA: There’s Specific, Measurable, Achievable….ĪC: Yeah. They do something so gigantic, that there’s no way that they’re going to be able to do it. But it was right on point, which was, a psychologist was recommending, come up with resolutions that you can actually follow through on. And I was just reading, I should have printed it. This is not working out for me.ĪC: Yeah, they go in too deep. This sucks! (laughs)ĪC: I got to use my credit card to pay the bills! (laughs) That first paycheck comes through and they’re like, I don’t have any money. They never maxed out their 401(k) plan in their life. It’s like, they’re sore, they don’t know what they’re doing, and it’s like their bodies are broken. And then they overdo it that first week and they blow themselves up. I’m going to lose weight, or get in shape, or get a six-pack. JA: The problem is is that people get super excited.

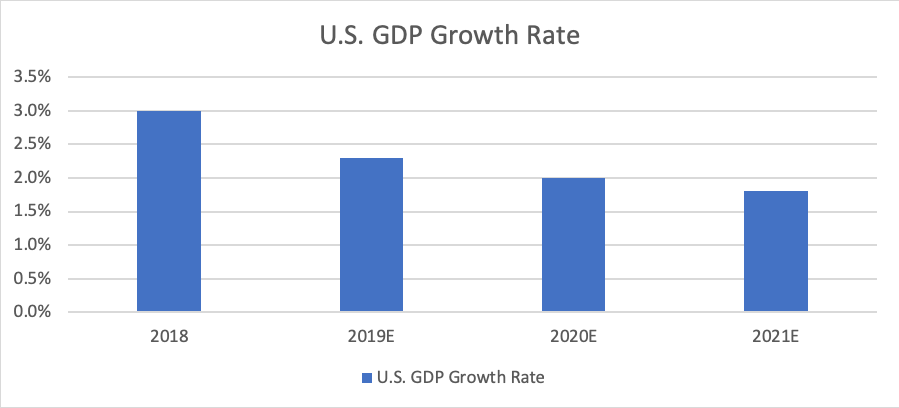

We also know that, you and I both have gym memberships, and we know in the first couple of weeks of January it’s packed and then it tapers off, and by the middle of February, it’s back to normal. I want to work on career.ĪC: We know that the getting fit, exercise, is a common one. I’ve seen so many different quadrants of, “I want to focus on health” and then the other one is spirituality. JA: Yeah, but I don’t necessarily get serious about it.ĪC: You don’t write them down and chart out in the progress? See if you’re on goal? So are you the kind of person that makes them or no? And it turns out, 32% don’t plan on making resolutions, so about a third of us don’t make resolutions, about two-thirds of us do. And then 13% want to take up a new hobby. 18% want to read more, 15% want to make new friends. Then after that, focus on self-care, 24%, such as getting more sleep. They are, eat healthier, get more exercise, and save more money. 37% of the people put this in one of their top resolutions. (laughs) Anyway, so here’s what they say. I’ll start out with, I’ve got the most common New Year’s resolutions for 2018, according to YouGov.ĪC: I don’t think so. Have you got yours? Have you thought about yours? You’ve been working on it over the break?ĪC: Well, I’ll tell you what I’ll do. That means it’s time to think about New Year’s resolutions. JA: The show is called, what, Your Money, Your Wealth?ĪC: It is, and I’m fairly excited today, Joe, because, this is our first show in 2018. Now, with the New Year’s resolution to attempt to prepare for each episode of Your Money, Your Wealth in 2018 – and likely failing – here are Joe Anderson, CFP® and Big Al Clopine, CPA. Will the bull run continue in 2018? Should we be preparing for a market slow down? Am I properly allocated? What would Jim Cramer do, and should I care?! Plus, tax filing season is approaching, and Big Al’s Big Brain contains a whole bunch of stuff you need to know about the new tax law before you start working on those 1040s. Today on Your Money, Your Wealth, he recaps 2017’s global Goldilocks economy.

That’s Brian Perry, CFP®, CFA® from Pure Financial Advisors. But it also speaks to the importance of time and perspective, is that if you have a portfolio that’s allocated appropriately for your time horizon, market movements are going to come and go, but you’re probably going to be okay.” – Brian Perry, CFP®, CFA®, Pure Financial Advisors I think that speaks to a couple things: it speaks to the importance of proper asset allocation. “ A 60/40 balanced portfolio in 2007, if somebody had hopped on a boat and sailed around the world for a couple of years, they would have come back in 2010, opened up their brokerage statement, and thought that nothing happened and it had been a dull market. (51:54) 9 Things You Need to Know About the New Tax Law (and a Few Extras).(40:22) 9 Things You Need to Know About the New Tax Law – MarketWatch.(27:38) Brian Perry: What About Bonds? Should I Change My Asset Allocation?.(18:59) What Will 2018 Hold for the Global Goldilocks Economy?.Will the bull run continue in 2018? Should we change our asset allocation to prepare our stock and bond portfolios for a market slow down? Are you properly allocated? What would Jim Cramer do, and should you care?! Plus, tax filing season is approaching, and Big Al’s Big Brain contains a whole bunch of stuff you need to know about the new tax law before you start working on those 1040s.

Brian Perry, CFP®, CFA® from Pure Financial Advisors recaps 2017’s global Goldilocks economy.

0 kommentar(er)

0 kommentar(er)